A Comprehensive Guide to Creating a Steady Stream of Income in Retirement

What is Retirement and Why Is It Important to Have a Steady Source of Income Retirement is the period in a person’s life when they stop working and start receiving a steady source of income to support their living expenses. It is important to plan for a steady source of income in retirement because it ensures that you will have enough money to live on and maintain your desired lifestyle. Investment Strategies to Create Multiple Sources of Retirement Income Investing is one of the most popular ways to create a steady source of income in retirement. There are many different investment options available, including stocks, bonds, mutual funds, and real estate. It is important to have a diversified investment portfolio to minimize risk and maximize returns. Creating Passive Income Streams Through Real Estate and Rental Property Real estate and rental property can also be a great way to create a steady stream of income in retirement. Owning rental property and collecting rent can provide a consistent income, and real estate investments can appreciate in value over time. Additionally, owning a vacation rental property can provide additional income during retirement. Exploring Other Options for Generating a Steady Source of Retirement Income There are also other options for generating a steady source of income in retirement. For example, starting a small business or side hustle in retirement can provide additional income. Additionally, there are many online jobs and gig economy opportunities that are suitable for retirees. Understanding Social Security Benefits & How They Can Help Supplement Your Retirement Income Social Security benefits can also help supplement your retirement income. It is important to understand how to qualify for Social Security benefits and how to maximize your benefits by delaying taking them until a later age. A Social Security benefits calculator can help you estimate how much you can expect to receive in benefits. Conclusion: The Importance of Creating a Diversified Income Stream in Retirement In conclusion, it is important to have a steady source of income in retirement to ensure that you will have enough money to live on and maintain your desired lifestyle. Creating a diversified income stream through a combination of investments, rental property, small business or side hustle, and Social Security benefits can help ensure a comfortable retirement. However, it’s also important to consider annuities and other guaranteed income options as part of your retirement income strategy. Annuities can provide a guaranteed stream of income for a specific period of time or for life, which can help provide financial security and peace of mind during retirement. It’s important to consult with a financial advisor to understand the best options for your personal financial situation and retirement goals.

A Comprehensive Guide to Estate Planning in Retirement and How to Ensure Your Family’s Financial Security

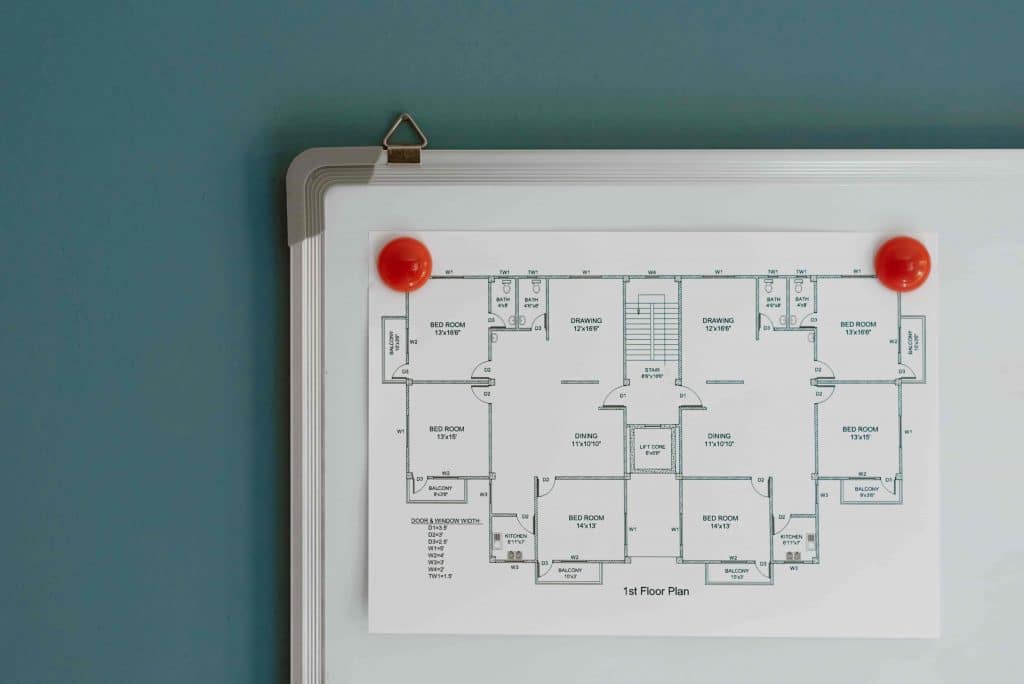

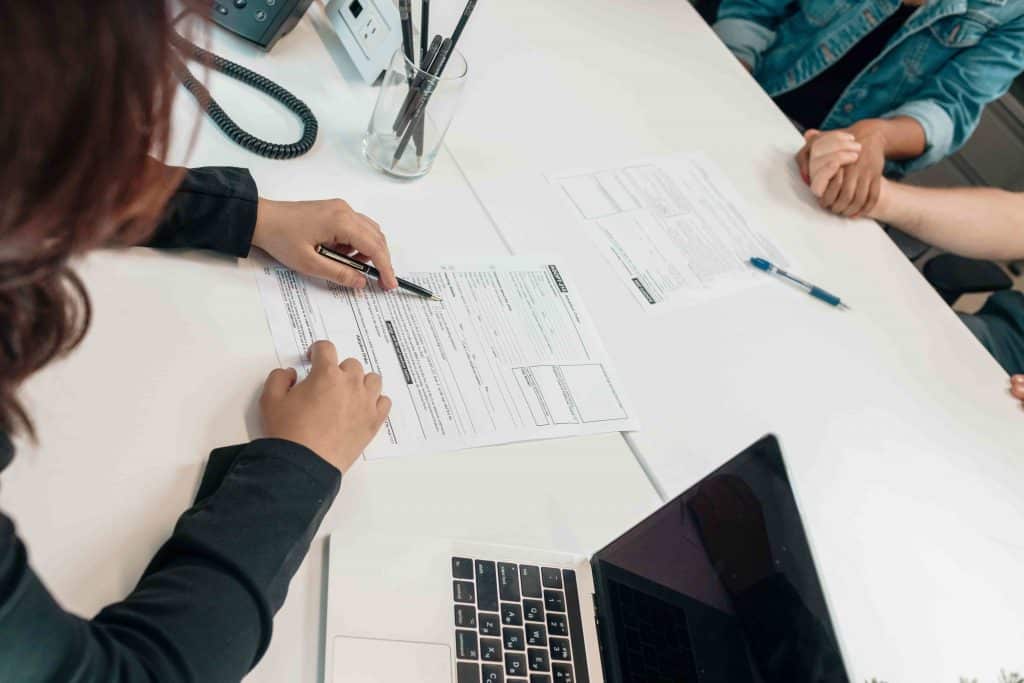

Introduction: What is Estate Planning and How Does it Affect Retirement? Estate planning is the process of organizing and planning for the distribution of your assets after you pass away. It is important to have a plan in place during retirement because it ensures that your assets will be distributed according to your wishes and that your loved ones will be taken care of financially. How to Set Up Essential Documents For Estate Planning and Why It’s Crucial There are several essential documents that are needed for estate planning, including a living will, trust document, last will and testament, and durable power of attorney. These documents ensure that your wishes are carried out and that your loved ones are protected in the event of your incapacity or death. The Benefits of Hiring a Professional Advisor for Estate Planning in Retirement Hiring a professional advisor for estate planning can be beneficial in retirement. An estate planning attorney or financial planner can help you navigate the legal and financial aspects of estate planning and ensure that your plan is tailored to your specific needs and goals. Understanding the Different Types of Assets Involved With Estate Planning When it comes to estate planning, there are three main types of assets to consider: real estate assets, taxable assets, and non-taxable assets. Understanding the different types of assets and how they are handled in estate planning can help you make informed decisions about how to distribute your assets and minimize taxes. How To Protect Your Assets Through Insurance & Investment Strategies For Retirement Insurance and investment strategies can also be used to protect your assets in retirement. Long-term care insurance can help cover the costs of care in the event of a chronic illness or disability, while life insurance policies can provide financial support for your loved ones in the event of your death. Additionally, investing in assets that appreciate in value, such as stocks or real estate, can help protect and grow your wealth for the future. Considerations When Choosing An Executor or Trustee for Your Estate Planning When it comes to estate planning, it’s also important to choose an executor or trustee who will manage your assets and carry out your wishes after you pass away. This person should be trustworthy, responsible, and able to handle the financial and legal aspects of estate management. Conclusion: The Importance of Estate Planning in Retirement for Your Family’s Financial Security In conclusion, estate planning is an essential part of retirement planning. It ensures that your assets will be distributed according to your wishes and that your loved ones will be taken care of financially. Hiring a professional advisor, understanding the different types of assets involved, protecting your assets through insurance and investment strategies, and choosing a responsible executor or trustee can all help ensure that your estate plan is comprehensive and tailored to your specific needs and goals.

4 Ways You Could Lose Your Social Security Benefits

What is Social Security and How Does it Affect Your Retirement? Social Security is a federal program that provides benefits to eligible individuals and their families in the event of retirement, disability, or death. These benefits are intended to provide financial security for individuals during their retirement years, but there are certain circumstances in which an individual may lose their benefits. Four Common Reasons You Could Lose Your Social Security Benefits Taxes on Social Security: Depending on your income, a portion of your Social Security benefits may be subject to federal taxes. This can reduce the amount of money you receive each month. For example, if you have other sources of income, such as a pension or rental income, up to 85% of your Social Security benefits may be subject to taxes. However, if you have a low income and no other sources of income, your benefits may not be subject to taxes. Social Security Earned Income Limits: If you continue to work while receiving Social Security benefits, your benefits may be reduced if your earned income exceeds certain limits. For example, if you are under your full retirement age (FRA) and earn more than $18,960 in 2021, $1 in benefits will be withheld for every $2 in earnings above the limit. If you reach your FRA in 2021 and earn more than $50,520, $1 in benefits will be withheld for every $3 in earnings above the limit. Garnishment of Social Security benefits: Social Security benefits can be garnished to pay certain debts such as child support, alimony, and taxes. However, there are limits on how much of your benefits can be garnished. The government can garnish up to 15% of your benefits to pay delinquent taxes, and up to 65% of your benefits to pay child support or alimony. It’s important to keep track of your debts and make payments on time to avoid having your benefits garnished. Taking benefits at the wrong time: If you start receiving benefits before your full retirement age, your benefits will be permanently reduced. For example, if your FRA is 67 and you start receiving benefits at age 62, your benefits will be reduced by 30%. This reduction can have a significant impact on your retirement income, so it’s important to consider when to start receiving benefits and how it will affect your overall retirement plan. The Impact of Early Retirement on Your Social Security Benefits Retiring early can also have an impact on your Social Security benefits. The earlier you start receiving benefits, the lower they will be. For example, if you begin receiving benefits at age 62, they will be 25% lower than if you wait until your full retirement age (FRA) of 67. What are the Different Ways You Can Protect and Increase Your Social Security Benefits? Save for retirement with a 401(k) or other retirement account: Building your own nest egg can help supplement your Social Security benefits and provide an additional source of income during retirement. Delay retirement: Waiting until your FRA to start receiving benefits will increase the amount you receive each month. Work with a financial advisor: A financial advisor can help you understand the best strategies for protecting and increasing your Social Security benefits and how to maximize your retirement income. Conclusion: Make Smart Decisions About Your Social Security Benefits To Secure a Comfortable Retirement Social Security benefits can play a crucial role in ensuring a comfortable retirement, but there are certain circumstances that can cause an individual to lose their benefits. Understanding the reasons why benefits may be lost and taking steps to protect them can help ensure a stable financial future during retirement. It’s important to consult with a financial advisor to understand how to protect and maximize your Social Security benefits.

6 Steps to Create the Perfect Retirement Plan and Secure Your Financial Future

What is a Retirement Plan & Why is it Important? A retirement plan is a financial plan that outlines how you will save, invest, and use your money in order to support yourself during retirement. It is important because it helps ensure that you will have enough money to live on and maintain your desired lifestyle during retirement. Step 1: Calculate Your Expected Living Expenses Post-Retirement The first step in creating the perfect retirement plan is to calculate your expected living expenses post-retirement. This will give you a better understanding of how much money you will need to save in order to support yourself during retirement. There are several online retirement budget calculators and retirement income calculators that can help you estimate your post-retirement expenses. Step 2: Determine What You Need to Save for Retirement & Set Goals Once you have a better understanding of your post-retirement expenses, you can then determine how much money you need to save for retirement. A saving-for-retirement calculator can help you estimate how much you need to save each month in order to reach your retirement goals. Setting long-term savings goals can also help keep you on track. Step 3: Choose the Right Savings Account & Investment Options The next step is to choose the right savings account and investment options for your retirement plan. This can include options such as 401k plans, traditional and Roth IRAs, and investment portfolios. It’s important to choose options that align with your risk tolerance and retirement goals. Step 4: Make Sure Your Retirement Plan Is On Track With Regular Reviews It’s important to regularly review your retirement plan to ensure that it is on track. This includes checking your progress toward your savings goals and making any necessary adjustments to your plan. Step 5: Make Preparations Now to Deal With the Costs of Long-Term Care One important aspect of retirement planning is to prepare for the potential costs of long-term care. This can include purchasing long-term care insurance or saving money specifically for this purpose. Step 6: Implement a Plan for Estate Planning Another important aspect of retirement planning is to implement a plan for estate planning. This includes understanding the laws and regulations surrounding estate taxes and making sure your assets will be distributed according to your wishes after you pass away. Conclusion: A comprehensive retirement plan is crucial to ensure your financial security in retirement. By following these 6 steps, you can create a plan that is tailored to your specific needs and goals, and that will help you achieve the retirement you want. It’s important to consult with a financial advisor to understand the best options for your personal financial situation and retirement goals.

8 Signs That You Are Ready to Retire and Enjoy Your Golden Years

Introduction: Retirement is a significant life event that many people look forward to, but it can also be a daunting experience. It’s essential to ensure that you are mentally, physically, and financially ready to retire before making the decision. In this article, we will explore the eight signs that you are ready to retire and enjoy your golden years. Sign #1: You Have Adequate Savings & Investments One of the most crucial signs that you are ready to retire is having adequate savings and investments. It’s essential to have enough money saved to cover your living expenses during retirement, which can include housing, healthcare, and other essential expenses. Additionally, having a diverse portfolio of investments can help provide a steady stream of income and protect against inflation. Sign #2: You Have a Clear Plan for Financing Your Retirement Having a clear plan for financing your retirement is essential for ensuring that you have the resources you need to live comfortably during your golden years. This includes developing a budget, creating a long-term investment strategy, and understanding your expected income sources in retirement. It’s also important to have a plan in place for unexpected events, such as long-term care or a medical emergency. Sign #3: You Feel Physically and Emotionally Prepared to Control of Your Life Retirement You Feel Physically and Emotionally Prepared to Retake Control of Your Life Retirement is a significant life change, and it’s essential to be emotionally and physically prepared for it. Being in good physical health is essential for enjoying your retirement years, and it’s essential to have a plan in place to maintain your health and well-being. Emotionally, it’s essential to be ready to take control of your life and create new goals and plans for the future. Sign #4: You Have a Strong Social Support Network Retirement can be a lonely time for some, especially if you have spent most of your life working. Having a strong social support network, including family and friends, can help ensure that you are not isolated during your retirement years. It’s also essential to have a support system in place for those times when you need a helping hand. Sign #5: You Feel Relaxed when thinking about the Future Retirement Planning can be stressful, and it’s essential to be relaxed when thinking about the future. If you’re feeling stressed or worried about your future in retirement, it may be a sign that you’re not ready to retire. Instead, take the time to evaluate your plans and make any necessary changes to ensure that you’re comfortable and confident in your retirement decision. Sign 6: You Experience Few or No Worrying Thoughts About the Future Another sign that you’re ready to retire is if you experience few or no worrying thoughts about the future. If you’re not worrying about how you’re going to make ends meet or how you’re going to fill your time in retirement, it’s a good sign that you’re ready for this next chapter in your life. Sign 7: You Feel That You Are Happier Than When Working If you’re feeling happier than when you were working, it’s a sign that you’re ready to retire. Retirement should be a time of relaxation and enjoyment, and if you’re already feeling happier than when you were working, it’s a good indication that you’re ready to make the transition. Sign 8: Your Profession Has a Low Risk of Losing Workforce Skills Due to Technology Changes The last sign that you’re ready to retire is if your profession has a low risk of losing workforce skills due to technology changes. With the rapid pace of technological advancement, many jobs are becoming obsolete. If you’re in a profession that is unlikely to be affected by technological changes, it’s a good sign that you’re ready. Conclusion: Reflect on Your Retirement Readiness and Make a Plan Each person’s retirement readiness will be unique and will depend on their own personal goals and circumstances. However, by taking the time to reflect on the eight signs discussed in this article and considering your own situation, you can gain a better understanding of whether you are ready to retire and enjoy your golden years. If you decide that you are ready, it’s important to have a solid plan in place to ensure that your financial and emotional needs are met in retirement. With a clear plan, you can feel confident and secure in your decision to retire and enjoy the next chapter of your life.

Taxes in Retirement Planning: What You MUST Know!

Overview of Taxes in Retirement Planning Retirement planning is a complex process that involves many different factors, including taxes. Understanding how taxes will affect your retirement income and savings is crucial for ensuring your financial security during your golden years. In this article, we will discuss various aspects of taxes in retirement planning and provide a comprehensive guide on what you need to know. How Much Income Tax Will You Have to Pay After Retirement? First, it’s important to understand how much income tax you will have to pay after retirement. Your taxable income after retirement will depend on the sources of your income, such as Social Security benefits, pension payments, and investment income. In general, the more income you have, the higher your tax rate will be. It’s important to plan ahead and understand how much tax you will have to pay in order to budget accordingly. Using Tax Efficient Strategies for Retirement Savings Next, it’s important to use tax-efficient strategies for your retirement savings. One way to save on taxes is to contribute to a 401(k) or another employer-sponsored retirement plan. These plans offer tax benefits, such as tax-deductible contributions and tax-deferred growth. Another way to save on taxes is to contribute to a Roth IRA, which allows for tax-free withdrawals in retirement. However, it’s important to be aware of the contribution limits and deductibility rules for these types of accounts. Understanding the Different Types of Taxable Retirement Accounts & Investments It’s also important to understand the different types of taxable retirement accounts and investments. A 401(k) plan, for example, is a tax-deferred account, meaning that you don’t have to pay taxes on the money you put into the account until you withdraw it. On the other hand, a taxable brokerage account is subject to taxes on any investment gains or dividends. Understanding the tax implications of different types of accounts can help you make the best decisions for your retirement savings. The Impact of Social Security Benefits on Your Taxes in Retirement Planning Social Security benefits can also have an impact on your taxes in retirement. The amount of Social Security benefits that are subject to taxes depends on your overall income and filing status. It’s important to understand how your Social Security benefits will be taxed in order to plan for this in your retirement budget. Using Long-Term Care Insurance as a Tax Strategy for Retirees Another tax strategy for retirees is to use Long-Term Care Insurance (LTCI) as a way to plan for potential long-term care costs. LTCI premiums can be tax-deductible up to certain limits and can help pay for long-term care expenses which are not covered by Medicare. It’s important to understand the rules and limits of this type of insurance as a tax strategy. Understanding Taxable Income After Retirement In addition, it’s important to understand how taxable income will change after retirement. Some retirees may find that they have a lower tax rate in retirement than they did while working, while others may find that they have a higher tax rate. It’s important to plan accordingly and understand how your taxable income will change. Taxes on Investments in Retirement Planning One important aspect of managing taxes as a retiree is understanding the tax implications of taking money out of your retirement accounts. Traditional 401k and IRA accounts are tax-deferred, meaning you don’t pay taxes on the money you put in, but you will have to pay taxes on the money you take out in retirement. On the other hand, Roth 401k and IRA accounts are funded with after-tax dollars, so you can take the money out tax-free in retirement. It’s important to consider the tax implications when deciding how and when to withdraw money from your retirement accounts. Managing Taxes as a Retiree Another way to manage taxes as a retiree is by being strategic about the types of investments in your retirement portfolio. For example, stocks and mutual funds that pay dividends are generally taxed at a lower rate than interest income from bonds. You can also consider investing in municipal bonds, which are issued by state and local governments and offer tax-free income. It’s important to consult with a financial advisor or tax professional to understand how your investments may be taxed in retirement. When it comes to taxes in retirement planning, it’s also important to be aware of the potential impact of estate taxes. If your estate exceeds a certain threshold, your beneficiaries may be subject to estate taxes. This threshold is currently $11.7 million for individuals and $23.4 million for couples, but it’s important to note that these limits are subject to change. To reduce the impact of estate taxes, you can consider gifting assets to your beneficiaries while you’re still alive, creating a trust, or purchasing life insurance. Finally, it’s important to remember that as a retiree, you may be eligible for certain tax credits and deductions. For example, if you’re over the age of 65, you may be eligible for a higher standard deduction. Additionally, if you’re paying for long-term care expenses for yourself or a spouse, you may be eligible for a tax credit. Consult with a tax professional to understand what credits and deductions you may be eligible for in retirement. Conclusion: The Importance of Tax Planning in Retirement In conclusion, taxes play a critical role in retirement planning and it’s important to understand the tax implications of your retirement savings, investments and withdrawals. Additionally, being aware of the tax implications of estate planning and taking advantage of tax credits and deductions can also help you maximize your retirement income. However, it’s important to consult with a tax professional to ensure that you’re making the best decisions for your individual situation. Remember, taxes change often and it’s best to keep updated with the latest laws.

How to Choose the Right Annuity for Your Retirement: A Guide for Beginners

What is an Annuity & How Does it Work? Annuities are a popular investment option for retirees looking for a steady stream of income in their golden years. An annuity is a contract between an individual and an insurance company, in which the individual makes a lump sum payment or a series of payments, and in return, the insurance company agrees to make periodic payments to the individual, starting either immediately or at a future date. Annuities are often used as a way to create a guaranteed income stream during retirement, providing a sense of financial security and peace of mind. Understanding Different Types of Annuities and their Benefits for Retirement Planning When it comes to choosing an annuity, there are several different types to consider. The most common types of annuities include fixed annuities, variable annuities, index-linked annuities, and immediate annuities. Fixed annuities offer a guaranteed fixed rate of return, which makes them a popular choice for those who prefer a steady and predictable income stream. Variable annuities, on the other hand, allow the policyholder to invest in a variety of different investment options, such as stocks and bonds, which means the rate of return can fluctuate. Index-linked annuities are similar to variable annuities, but the rate of return is based on the performance of a specific stock market index, such as the S&P 500. Immediate annuities, also known as income annuities, provide guaranteed income payments starting immediately after the purchase of the annuity, rather than at a future date. How to Evaluate Different Annuity Providers Before Making a Decision When choosing an annuity, it is important to evaluate the financial strength and ratings of the insurance company that is offering the annuity. This will give you an idea of the company’s ability to pay out on the annuity in the future. Financial ratings agencies such as A.M. Best, Moody’s, and Standard & Poor’s provide ratings for insurance companies. These ratings take into account the company’s financial stability, claims-paying ability, and overall creditworthiness. It is also important to compare annuity rates from different providers. Annuity rates can vary greatly depending on the type of annuity and the insurance company offering it. It is important to shop around and compare rates to ensure that you are getting the best deal. What are the Pros & Cons of Investing in an Annuity? One of the main benefits of investing in an annuity is the tax-deferred growth of the investment. This means that your money can grow without being subject to taxes until you begin taking withdrawals. Additionally, annuities can provide a guaranteed stream of income in retirement, which can help to ensure that you will have enough money to cover your expenses. However, there are also potential downsides to investing in an annuity. Annuities can have high fees and charges, which can eat into your returns. Additionally, if you need to withdraw money from the annuity before a certain age, you may be subject to penalties. It is important to carefully consider the pros and cons of investing in an annuity before making a decision. Finding the Right Balance Between Risk & Reward When Selecting an Annuity Investment Option When selecting an annuity investment option, it is important to find the right balance between risk and reward. Fixed annuities offer a guaranteed rate of return, but the returns are typically lower than those of other types of annuities. Variable annuities, on the other hand, offer the potential for higher returns, but they also come with more risk. It is important to assess your investment risk profile before selecting an annuity investment option. If you are comfortable with more risk, a variable annuity may be a good choice. If you prefer a more conservative approach, a fixed annuity will be your best option. Tips for Combining Multiple Annuities to Create a Customized Retirement Income Plan When it comes to annuities, one size does not fit all. Each individual’s retirement income needs are unique, and different types of annuities can be used to create a customized retirement income plan. One strategy to consider is annuity laddering. This involves purchasing annuities with different maturity dates, creating a stream of income that can be received at different times. This can provide both a guaranteed income stream and the flexibility to access funds at different times, depending on your needs. Another strategy is annuity stacking, which involves purchasing multiple annuities with different payout options, such as immediate and deferred annuities. This can provide a mix of guaranteed income and potential growth opportunities. The key is to diversify your annuity investments, so that you have a mix of immediate and deferred annuities, as well as different types of annuities, such as fixed and variable annuities. The Role of Annuities in a Comprehensive Retirement Plan Annuities can play an important role in a comprehensive retirement plan. They can provide a guaranteed stream of income, which is particularly important for retirees who are concerned about outliving their savings. However, it’s important to remember that annuities are just one piece of the retirement income puzzle. They should be used in conjunction with other income sources, such as Social Security, pension income, and investment income. When it comes to retirement income planning, it’s essential to have a mix of guaranteed and non-guaranteed income sources. Annuities can provide guaranteed income, while investments can provide the potential for growth. A diversified portfolio can provide a balance of risk and reward, which is important for retirees who want to protect their savings while still having the opportunity for growth. In conclusion, incorporating annuities into your retirement plan can provide a reliable source of income and help ensure financial security in your golden years. It is important to carefully evaluate different annuity options and providers and to understand the pros and cons of investing in an annuity. By understanding the different types of annuities and their benefits, as well as strategies for maximizing your income, you can make an informed decision and create

Maximizing Your 401k: How a 401k Advisor Can Help You Create a Customized Retirement Plan

Introduction: What is a 401k and How Does it Work? A 401k is a type of savings plan offered by employers to help employees save for retirement. It’s a tax-deferred savings plan, meaning that the money contributed to it is not taxed until it’s withdrawn. Employers often offer matching contributions as an incentive for employees to save for retirement. The money in a 401k can be invested in various options, such as mutual funds, bonds, and stock options, and can grow over time. The Benefits of Working with a 401k Advisor to Maximize Your Savings Working with a 401k advisor can be extremely beneficial for maximizing your retirement savings. A 401k advisor can help you understand the various investment options available to you and help you create a customized retirement plan that aligns with your personal financial goals. They can also help you understand the fees associated with different investment options, and help you make informed decisions about how to allocate your assets. Additionally, a 401k advisor can help you monitor and adjust your investments over time to ensure that your plan remains on track. How to Choose the Right 401k Advisor for Your Retirement Plan When choosing a 401k advisor, it is important to consider their qualifications, experience, and reputation. Look for an advisor who is a Certified Financial Planner (CFP) or a Registered Investment Advisor (RIA), as these professionals have met specific educational and experience requirements. Additionally, it is important to find an advisor who has a track record of success and is able to provide references from satisfied clients. It’s also important to consider the fees associated with working with a 401k advisor. Some advisors charge a flat fee for their services, while others charge a percentage of assets under management. Be sure to fully understand the fees associated with working with an advisor before making a decision. Creating a Customized Retirement Plan with your Own Personal Financial Goals in Mind When working with a 401k advisor, you will have access to a wide variety of investment options. These options can include mutual funds, exchange-traded funds (ETFs), stocks, and bonds. Your advisor will work with you to develop an investment strategy that aligns with your risk tolerance and financial goals. They will also be able to provide guidance on diversifying your portfolio, which is an important aspect of maximizing your savings and minimizing risk. Another important benefit of working with a 401k advisor is their ability to provide ongoing monitoring and management of your retirement plan. Your advisor will regularly review your portfolio, making sure it is aligned with your goals and making any necessary adjustments to ensure it remains on track. They will also be able to provide updates on any changes in the market or economic conditions that may impact your retirement savings. Conclusion: Start Planning for Retirement Now In conclusion, a 401k advisor can be a valuable resource for maximizing your retirement savings and creating an ideal retirement plan. They can provide guidance on investment options, ongoing monitoring and management of your portfolio, and help with financial goal setting. It’s important to choose the right advisor by considering their qualifications, experience, and reputation, as well as the fees associated with their services. With the help of a 401k advisor, you can rest assured that your retirement savings are on track, and you’ll be able to maximize your savings.

Pros and Cons of Rolling Over Your 401k to an IRA

What Is a Rollover and What Are the Benefits & Risks of Converting Your 401k to an IRA? A rollover is a process of transferring funds from one retirement account to another, such as a 401k to an IRA. This can be a great way to gain more control over your investments and potentially lower your fees. However, there are also some potential drawbacks to consider before making the switch. It’s important to understand the benefits and risks of converting your 401k to an IRA to make the best decision for your retirement savings. What Are the Pros of Rolling Over Your 401K to an IRA? More Control Over Your Investments: With an IRA, you have more control over your investments than you would with a 401k. You have a wider range of investment options, including stocks, bonds, and mutual funds, which can help you create a more diversified portfolio. Lower Fees: IRAs often have lower fees than 401ks. By rolling over to an IRA, you may be able to save on administrative and management fees, which can add up over time. Tax Benefits: Depending on the type of IRA you choose, you may be able to take advantage of certain tax benefits. For example, with a Roth IRA, your contributions are made with after-tax dollars, so you won’t pay taxes on the money when you withdraw it in retirement. What Are the Cons of Rolling Over Your 401K to an IRA? More Decisions and Responsibility: With an IRA, you have more decisions to make and more responsibility for managing your investments. This can be overwhelming for some individuals, and it’s important to be prepared to take on this additional responsibility. Higher Fees in IRAs Than in a Qualified Employer Plan: While IRAs may have lower fees than 401ks, they still have fees, which can add up over time. It’s important to compare the fees of different IRA providers to ensure you’re getting the best deal. The complexity of IRA rules: IRAs have more complex rules than 401k plans, which can make it harder to understand and follow the regulations. Who Is Eligible for a Rollover & How To Set When it comes to rolling over your 401k to an IRA, there are certain eligibility requirements that must be met. In general, anyone who has a 401k plan through their employer is eligible to rollover their funds to an IRA. However, there are certain restrictions and rules that must be followed in order to do so. First, it’s important to understand that there are two types of rollovers: direct rollovers and indirect rollovers. A direct rollover is when the funds are transferred directly from the 401k plan to the IRA, without passing through the individual’s hands. This type of rollover is not subject to taxes or penalties and is the recommended method for rolling over funds. An indirect rollover, on the other hand, is when the funds are distributed to the individual and then deposited into an IRA within 60 days. This type of rollover is subject to taxes and penalties and is not recommended unless it is absolutely necessary. In order to be eligible for a rollover, individuals must also meet certain age and employment requirements. For example, individuals must be at least 59.5 years old to rollover their funds without incurring penalties. Additionally, individuals who are still employed by the company that sponsors their 401k plan may be subject to different rules and restrictions. To set up a rollover, individuals should first consult with their employer and/or 401k plan administrator to understand the specific rules and requirements for their plan. They should also consult with a financial advisor or IRA custodian to understand the options available for rolling over their funds and to compare the fees and investment options of different IRA custodians. It’s also important to research the different types of IRA accounts (traditional IRA or Roth IRA) and which one will best suit their retirement goals. Once the individual has decided which IRA custodian and account type to use, they will need to fill out the necessary paperwork and provide the IRA custodian with the information needed to initiate the rollover. Options for Rollover: Traditional IRA or Roth IRA? When it comes to deciding on a rollover option, one of the most important decisions to make is whether to choose a traditional IRA or Roth IRA. Both types of IRAs offer different benefits and drawbacks, and it is important to understand the differences before making a decision. A traditional IRA allows for tax-deductible contributions, meaning that the money you contribute to your IRA is tax-free in the year it is contributed. This can be a significant advantage if you are in a higher tax bracket. However, when you withdraw money from your traditional IRA during retirement, it will be taxed as income. On the other hand, a Roth IRA is funded with after-tax dollars, meaning that you do not get a tax deduction for your contributions. However, the money in a Roth IRA grows tax-free, and withdrawals during retirement are also tax-free. This can be a significant advantage if you expect to be in a higher tax bracket during retirement. Another key difference between traditional and Roth IRAs is the age at which you are required to start taking distributions. With a traditional IRA, you must start taking required minimum distributions (RMDs) at age 72. With a Roth IRA, there are no RMDs, so the money can continue to grow tax-free for as long as you live. When deciding between a traditional IRA and Roth IRA, it is important to consider your current tax bracket, your expected tax bracket during retirement, and your retirement income needs. If you expect to be in a higher tax bracket during retirement, a Roth IRA may be the better option. However, if you are currently in a high tax bracket and expect to be in a lower bracket during retirement, a traditional IRA may be more advantageous. It is

The Advantages of Working with a Fee-Only Financial Advisor for Your Retirement Planning Needs

What is a Fee-Only Financial Advisor and What are the Advantages of Working with One? When it comes to retirement planning, it’s important to work with a financial advisor who has your best interests in mind. A fee-only financial advisor is one such type of advisor, and they can offer many advantages when it comes to planning for your golden years. But what exactly is a fee-only financial advisor and why should you consider working with one? A fee-only financial advisor is a professional who charges clients based on a set fee, rather than earning commissions on the sale of financial products or services. This means that a fee-only advisor is not incentivized to sell you certain products or services, and can instead offer unbiased advice that is tailored to your specific needs and goals. This type of advisor is also known as a fiduciary, which means that they are legally required to act in the best interests of their clients. Understanding the Different Types of Advisors & How They Charge for Their Services When it comes to financial advisors, there are a few different types and ways that they can charge for their services. Some advisors may earn commissions on the sale of financial products or services, which can create a conflict of interest. Other advisors may charge based on a percentage of assets under management, which can be costly for clients with a larger portfolio. On the other hand, a fee-only financial advisor charges a set fee for their services, which can be a flat rate or an hourly rate. This type of pricing structure allows clients to budget for the cost of working with an advisor and can help to ensure that the advisor is focused on providing unbiased advice that is tailored to the client’s specific needs and goals. The Advantages of Working with a Fee-Only Financial Advisor One of the main advantages of working with a fee-only financial advisor is that they are a fiduciary, meaning they are legally bound to act in their clients’ best interests. This means that their advice is unbiased and they do not have any hidden agendas or conflicts of interest. This is in contrast to fee-based advisors who may also earn commissions or other incentives for selling certain financial products to their clients. Another advantage of working with a fee-only financial advisor is that they can provide a wide range of services, including retirement planning, investment management, tax planning, and estate planning. They can also help you create a comprehensive financial plan that takes into account your specific goals and circumstances. Additionally, a fee-only financial advisor can help you save money in the long run by providing cost-effective advice and helping you avoid unnecessary fees and expenses. They can also help you minimize taxes and maximize your returns on investments. What to Look For When Choosing a Fee-Only Financial Advisor When choosing a fee-only financial advisor, it’s important to do your research and compare different advisors. Look for an advisor who is a certified financial planner (CFP) or a chartered financial consultant (ChFC) as these designations indicate that the advisor has met certain educational and experience requirements. You should also check the advisor’s background and experience, including how long they have been in business and what types of clients they typically work with. It’s also a good idea to ask for references and to speak with current or past clients to get an idea of their experience with the advisor. It’s also important to make sure the advisor’s fee structure is transparent and that they disclose all of their fees upfront. Look for an advisor who charges an hourly rate or a flat fee, as these types of fees tend to be more straightforward and easier to understand than commission-based fees. When you meet with a potential advisor, be sure to ask about their investment philosophy and strategies, and make sure that they align with your own goals and risk tolerance. It is also important to make sure that you have a good rapport with the advisor and that you feel comfortable discussing your financial situation with them. Finally, it’s important to make sure that the advisor is registered with the Securities and Exchange Commission (SEC) or another regulatory body. This can be done by checking the SEC’s Investment Adviser Public Disclosure (IAPD) website. Tips for Maximizing Your Relationship with a Fee-Only Financial Advisor When working with a fee-only financial advisor, it’s important to establish clear goals and expectations for your retirement planning journey. This includes setting realistic timelines for achieving your goals and regularly reviewing and updating your plan as needed. Communication is key in any advisor-client relationship, so make sure to ask questions and voice any concerns you may have. A good advisor will welcome open and honest dialogue and will be happy to provide you with the information and guidance you need to make informed decisions about your finances. Another important aspect of working with a fee-only advisor is staying organized. Your advisor will likely request a variety of financial documents and information, so it’s important to have everything in order and easily accessible. This will make the process of creating a comprehensive retirement plan much smoother and less time-consuming. The Role of a Fee-Only Financial Advisor in a Comprehensive Retirement Plan A fee-only financial advisor can play a vital role in creating a comprehensive retirement plan that addresses all aspects of your financial life. This includes not just saving for retirement, but also creating a plan for generating income in retirement, managing taxes, and preparing for unexpected events. One of the main benefits of working with a fee-only advisor is that they are required to act as a fiduciary, meaning they are legally bound to act in your best interests. This is in contrast to fee-based advisors, who may also earn commissions for selling financial products. A fee-only advisor’s sole source of income is the fee you pay for their services, which