Introduction:

What is Estate Planning and How Does it Affect Retirement?

Estate planning is the process of organizing and planning for the distribution of your assets after you pass away. It is important to have a plan in place during retirement because it ensures that your assets will be distributed according to your wishes and that your loved ones will be taken care of financially.

How to Set Up Essential Documents For Estate Planning and Why It’s Crucial

There are several essential documents that are needed for estate planning, including a living will, trust document, last will and testament, and durable power of attorney. These documents ensure that your wishes are carried out and that your loved ones are protected in the event of your incapacity or death.

The Benefits of Hiring a Professional Advisor for Estate Planning in Retirement

Hiring a professional advisor for estate planning can be beneficial in retirement. An estate planning attorney or financial planner can help you navigate the legal and financial aspects of estate planning and ensure that your plan is tailored to your specific needs and goals.

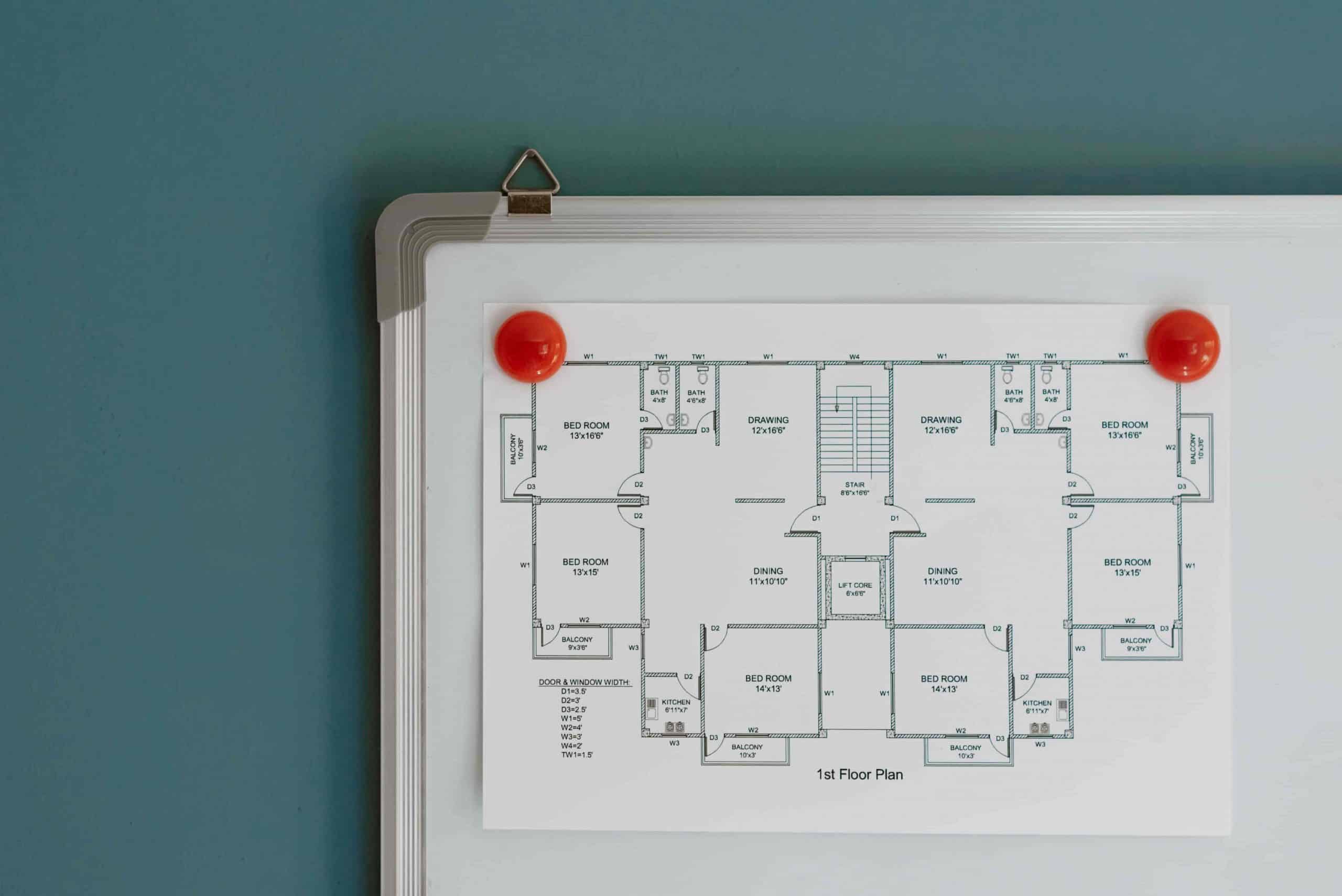

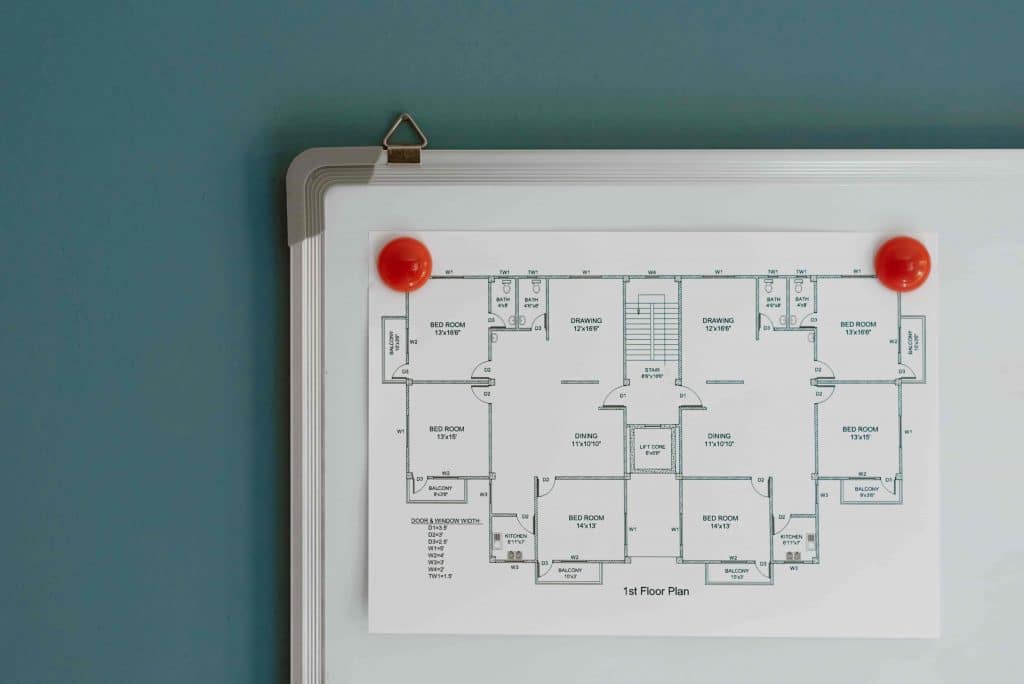

Understanding the Different Types of Assets Involved With Estate Planning

When it comes to estate planning, there are three main types of assets to consider: real estate assets, taxable assets, and non-taxable assets. Understanding the different types of assets and how they are handled in estate planning can help you make informed decisions about how to distribute your assets and minimize taxes.

How To Protect Your Assets Through Insurance & Investment Strategies For Retirement

Insurance and investment strategies can also be used to protect your assets in retirement. Long-term care insurance can help cover the costs of care in the event of a chronic illness or disability, while life insurance policies can provide financial support for your loved ones in the event of your death. Additionally, investing in assets that appreciate in value, such as stocks or real estate, can help protect and grow your wealth for the future.

Considerations When Choosing An Executor or Trustee for Your Estate Planning

When it comes to estate planning, it’s also important to choose an executor or trustee who will manage your assets and carry out your wishes after you pass away. This person should be trustworthy, responsible, and able to handle the financial and legal aspects of estate management.

Conclusion: The Importance of Estate Planning in Retirement for Your Family’s Financial Security

In conclusion, estate planning is an essential part of retirement planning. It ensures that your assets will be distributed according to your wishes and that your loved ones will be taken care of financially. Hiring a professional advisor, understanding the different types of assets involved, protecting your assets through insurance and investment strategies, and choosing a responsible executor or trustee can all help ensure that your estate plan is comprehensive and tailored to your specific needs and goals.